دورة تداول وتسوية حسابات الحفظ الأمين

After completing the transfer of records of securities owners to the Center and depositing the documented part thereof at the end of 2004, the Center began applying clearing and settlement procedures for trading contracts executed in the stock exchange on the basis of delivery against payment, so that the sold security is not delivered until after payment of its price. Delivery against payment is one of the most important criteria applied in the capital markets.

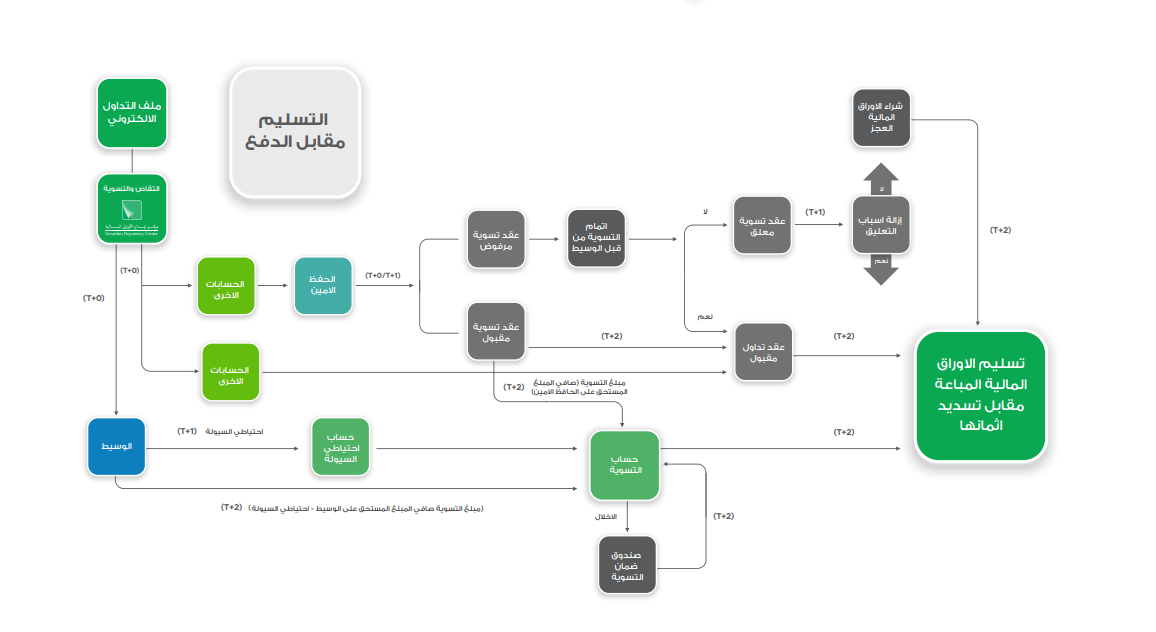

The Instructions for Registration, Deposit and Settlement of Securities for the year 2017 are considered the legal and legislative framework that governs the clearing and settlement procedures that take place through the Securities Depository Center. Where the ownership of the deposited securities is transferred from the account of the selling investor with the selling broker to the account of the buyer investor with the buying broker under electronic entries based on the daily trading file received by the center from the stock exchange, where the securities remain stuck in the buyer’s account until the completion of the settlement and payment procedures. Any transfer or mortgage may be made on it during that period.

In order to enhance control procedures, risk management and data accuracy in the securities trading process, an electronic link system has been implemented between the Depository Center and the Amman Stock Exchange in order to improve the technical work environment of the capital market institutions. Trading orders in terms of ownership percentages on the security, account ownership, and investor and broker data.

Financial settlements are made between the brokers and custodians through the Center and by means of financial transfers from the accounts of the brokers and custodians to the settlement account of the Center at the Settlement Bank, after which the Center works to transfer these amounts to the brokers and custodians who are entitled to them, as the Central Bank of Jordan has been approved as a bank For settlement, the Securities Depository Center was an indirect member of the Instant Total Settlement System - Jordan (RTGS-JO), but on 05/26/2015 the center joined the International Financial Telecommunications Association (SWIFT) and thus the center became a direct member of the Instant Total Settlement System Eh (RTGS-JO).

The center works to conduct a clearing process, according to which the financial amounts due to the broker or to him are determined based on all the trading contracts executed by him and the settlement contracts accepted by the custodians by subtracting the total value of the purchase and sale settlement contracts from the total value of the sale and purchase settlement contracts. For that day, the amount to be paid by the broker is divided into:

Liquidity reserve amount which is paid at T+1.

The settlement amount, which represents the difference between the amount owed by the broker and the amount he paid as a liquidity reserve, which is paid at T+2

While the center works to conduct a clearing process, according to which the financial amounts due to the custodian or to him are determined based on the settlement contracts accepted by him, by subtracting the total value of the purchase settlement contracts accepted by the custodian from the total value of the sale settlement contracts accepted by the custodian for the same day trading

The broker and the custodian are notified electronically of the amounts owed to him or him on the relevant trading day, and if the broker or custodian does not pay the settlement amount owed by him within the specified dates for that, he is considered in breach of his obligations, and the center takes the necessary measures to complete financial settlements through the Settlement Guarantee Fund .

The following is an illustration of the securities price settlement cycle:

Delivery against payment