Clearing & Settlement

After completing the transfer of shareholders' registers to the SDC and the deposit of the authenticated part of those

the SDC and the deposit of the authenticated part of those

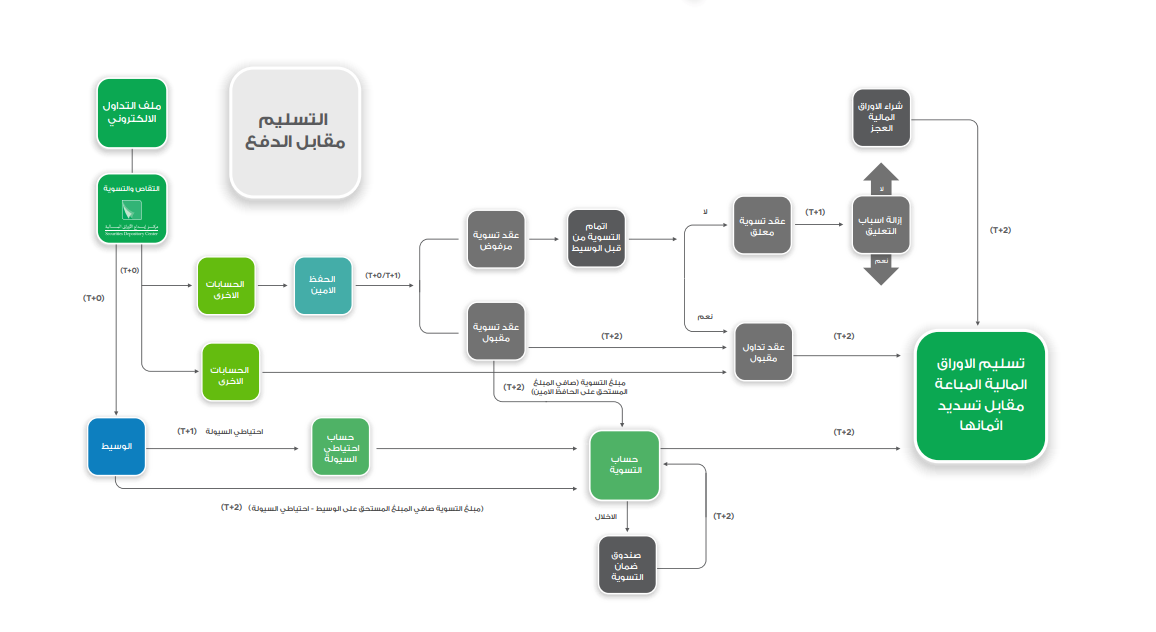

registers at the end of 2004, the SDC started during the beginning of 2005 to apply the clearing & settlement measures for trading contracts executed at the ASE on the basis of Delivery versus Payment (DvP), where transfer of sold securities is against payment of funds. DvP is considered an important international standard applied in capital markets.

The Instructions of Registration, Deposit and Settlement of Securities for the Year 217 are considered the legal and legislative framework for the clearing & settlement measures executed through the SDC. Ownership of deposited securities is transferred from the selling investor's account with the selling broker to the buying investor's account with the buying broker via book entry in accordance with the daily trading file delivered to the SDC by the ASE where the securities remain suspended in the buyer's account until the fulfillment of the settlement measures and the payment of their value. No transfer or pledge is permitted during that period.

In order to enhance the procedures of control, risk management and data accuracy in the trading process, the SDC-ASE tight coupling was implemented to improve the technical environment of institutions of the Capital Market. The procedures of risk management are conducted by exchanging information between ASE and SDC and direct verification of selling/ buying orders in term of securities ownership percentages, account ownership and investors and brokers data.

Financial settlements between brokers and custodians are conducted through the SDC by money transfers from the brokers' and custodians' accounts to SDC Settlement Account at the Settlement Bank. Consequently, the SDC transfers those funds to the brokers and custodians who should receive funds. The Central Bank of Jordan was chosen as the Settlement Bank and the SDC became an indirect member of the RTGS-JO. Since 26/05/2015, the SDC has joined the Society for Worldwide Interbank Financial Telecommunication (SWIFT), thus, the SDC has become a direct member for Real Time Gross Settlement System (RTGS-JO).

The SDC conducts the clearing process to determine the amounts that the broker must pay or receive in accordance with all the trading contracts executed by the concerned broker and the settlement contracts accepted by the custodians. This is done by subtracting the total amount of buying trading contracts and selling settlement contracts from the total amount of selling trading contracts and buying settlement contracts for the trading day. The amount that the broker must pay is divided into:

| ● | The Liquidity Reserve amount that is paid on (T+1). |

| ● | The settlement amount, which represents the difference between the net to pay and the Liquidity Reserve amount that is paid on (T+2). |

Whereas the SDC conducts the clearing process to determine the amounts that the custodian must pay or receive in accordance with all the settlement contracts accepted by the concerned custodian by subtracting the total amount of selling settlement contracts from the total amount of buying settlement contracts for the trading day.

The broker and Custodian are notified electronically of the amount due to be paid or received by him. If the broker or Custodian does not pay the Liquidity Reserve amount or the settlement amount within the specified timeframes, he is considered in breach of his obligations and the SDC takes the necessary measures to fulfill the financial settlement through the Settlement Guarantee Fund.

(To view the course on trading and settling custodial accounts, click here)